It's been a busy few days on the Energous front, and will likely stay that way with CES coming up, along with watching how their share price will fluctuate and if any more insiders have cashed in. We'll almost certainly see plenty of new information and revelations, which will come in a little at a time, and it's hard to judge if they should just be included as addenda or merit a post in themselves. My last post had a few additions to it since I first published it, and it got to the point where I'm going to regurgitate some of it in a new post. If you read that post really recently, there won't be too much new here for you.

Before I begin though, I just want to remind everyone that this is a system that needs a safety cutoff and an exclusion-zone larger than the operating-zone to charge your phone in about a week, at closer than 1 meter (if at all), if you hold it perfectly in alignment. Sounds amazing, doesn't it?

Energous have, until now, relied on ambiguity and vague promises which could not be argued with due to lack of information, but data is now public due to the FCC filing. This data now gives us the first concrete (though incomplete) numbers to show what those with an understanding of physics and RF have always suspected - there's nothing new or amazing here. Energous are not finding that "one weird trick" that bypasses the laws of physics, or have a Nobel-prize level discovery. The emperor really does have no clothes, but instead has an awesome marketing and PR department.

A summary of what's here:

1) Energous could increase the power delivered, but would then have to increase the size of the keep-out-zone, likely to room-scale for most reasonable charge rates. This is also dependent upon perfect receiver alignment.

2) Charge rates shown in the FCC report look to be for phone-sized objects. Move to wearables and the power delivered will drop, likely significantly.

3) The system has very poor beamforming capabilities and the point of highest power is not often at the target location. It is not a precision system, comforting when it can hurt you...

4) Some people are mistakenly reporting that the system transfers power at ~2.4GHz with a max 400 microWatts. This is the communications part of the system, not for power transfer.

5) The system shown in the FCC filings is vastly inferior in every regard to the promises from January 2015.

More Power!

Energous appear limited in how much power they transmit primarily due to the SAR restrictions, which they are currently at. The FCC data shows they are at 0.966W/kg at 50cm, while the limit is 1.6 W/kg. If we assume a measurement and manufacturing tolerance of 2 dB total (63%) then that takes the 0.966 to 1.58 W/kg - basically they are working at the limit, there's no more headroom here to expand.

What can get them more power at any given location is to extend the "keep-out-zone" further, essentially the distance from the transmitter at which the SAR value is around 0.97 W/kg. Now we are dealing with near-field effects so it's hard to say exactly, but let's for now say that the SAR power value increases linearly with the receiver power value. Let's increase the power at 90 cm from 30 mW to 45 mW - in this case the keep-out-zone moves to 75 cm and your phone still isn't charging. Now double to 60 mW and the zone is at 1 meter - you're standing inside the unsafe perimeter and the system will of course shut off, your charge rate is zero. And your phone wouldn't charge anyway. Now let's raise the power to 500 mW, the bare minimum to charge a phone, and the keep-out zone is now 8.3 meters - larger than the room you're in and probably the room next to it, and the one after that as well.

Depending on beamforming the exclusion zone may increase slower than that, but even under best case assumptions it's still expanding to room-sized danger zones for pretty pathetic charge rates.

No! You're not holding your phone correctly!

Also remember that these numbers in the FCC report are for a receiver in perfect alignment for the transmitter - rotate 90 degrees in two out of three axes and you get nothing. Even rotating in the other axis reduces power by around 20% at 50 cm.

Consider how you stand and hold your phone while using it - likely at around 45 degrees to the floor. You'll probably lose a good 30% of power at least, not including what your hand might absorb instead. Now consider how you place your phone on a table when you're not using it - flat. With that orientation, you're getting close to the "nothing" for power delivery. Actually use your phone, and charge rate will vary considerably but the key thing is this - the numbers you see reported by Energous are as good as it will get, under perfect circumstances.

Low Power for Phones - Ideal for Wearables!

As the initial excitement of the Part 18 approval fades, it's becoming clear to even the most ardent Energous supporter that the power levels here are so low as to be useless for phone charging, even if they increase by near an order of magnitude. What I'm seeing though from the Energous faithful is grasping at "charging wearables" as the killer app for Energous. Unfortunately, that's just not going to happen either.

The receive antenna Energous use is likely a half-wave dipole antenna (think the bars in a TV antenna), and given wavelength at 913 MHz is 33cm, a half wavelength in free space is 16.5 cm (half wave dipole antennas are actually slightly shorter than the free space half wavelength). Given a phone is usually 10 to 14 cm long, the antenna will be close to that, not perfect but some dielectrics around it and it's close enough. Some info on effective antenna area is here.

Now look at your watch - how large is that? What's the size of an antenna you can put in there? It's much smaller, with a reduced size comes reduced power delivery, and at around 1 to 2 cm probably quite a reduction. Maybe they can use a patch antenna and get the size needed down with a high value dielectric? We'll conveniently forget that patch antenna are highly directional, even more than what is seen in the FCC test. In that case the patch impedance gets high, and the power gathered will drop (power is voltage squared divided by impedance). Here's an online tool for calculating patch antenna sizes and impedances - in this case it fits in a wearable, at around 16 by 24 by 2.0 mm, but at 4.5 kOhms will produce about 1.5% of the power of a standard 70 ohm half wave dipole antenna. Oh dear.

Then we have the orientation issue - this thing is on your wrist or body, right? How do you ensure perfect orientation to get the power needed? Good luck there.

AirPods have a 1.5 Wh battery - standard perfectly at the 50 cm danger-zone limit and if you get the maximum 100 mW they'll charge in 15 hours. Except they won't, you'll get a fraction of that, and if you move the system shuts off.

So no, wearables aren't going to cut it for the huge market either.

Where's the Power Going?

When using a phased array to send power with precision, you ideally want a large grid of transmitters spaced half a wavelength apart, many many wavelengths total on each side, and a target far enough to be in the farfield (many wavelengths away). At 913 MHz, Energous have a line of only 12 antenna, spaced 0.2 of a wavelength apart, about 2.5 by 0.2 wavelengths on each side, and a target barely 2 wavelengths away. It's an awful design if you want to try to control where the beam goes, and you can see that in their own beamplots. The star in the image below is where the power is supposed to be beamed - does this image fill you with confidence as to what's getting powered?

This arrangement might have been enough if they could operate at 5.8 GHz and wavelengths were over 6 times smaller - but the FCC killed that, as no doubt the system wrecked any wWiFi in the vicinity.

Bottom line - this thing sends power everywhere and there is no precision about it. IMO it's a brute force attempt to simply get FCC approval under Part 18 and damn the practicality.

The 2.4GHz Band is for Communications, Not Power

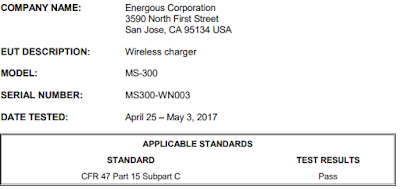

I'm seeing quite a few people refer to the 2.4GHz band Part 15 approval that was granted (in addition to the Part 18 approval for 913 MHz) where maximum power of 0.4 mW (400 millionths of a Watt) is stated. This is not for power transfer, this is Energous getting the communications component of the system approved.

They state they use the 2.4GHz band, Bluetooth LE, for the receiver to communicate to the transmitter that at least 30 mW is being received to continue power. It is not the maximum power transferred - as much as Energous send out tiny amounts of power, this isn't the number to be looking at.

Diminished Expectations

Energous launched with the promise of charging multiple devices, at up to 15 feet, at multiple Watts. Here's part of their January 2015 media blitz:

A new wireless power “router” being shown at CES can charge multiple devices in a 15-foot radius.

The two-tone rectangular box you see mounted on the wall up above is a WattUp transmitter from the wireless power people at Energous. WattUp is capable of delivering .25W to 12 devices or 4W to up to four devices (up to five feet away, dropping to 1W at 15 feet) at the same time, and it’s smart about how it does it.

Inside the “router” there’s a Bluetooth module. It sniffs out compatible devices and helps establish connections to them. Once they’re connected, power is beamed out over frequencies in the 5.7-5.8GHz range, but it doesn’t just constantly blast devices with RF power packets.

Here is a brief summary of the results of the amount of actual power delivered to a device at varying distances with a single WattUp transmitter. Power received at zero to five feet measured 5.55 watts compared to our targeted performance of 4 watts. Power received at five to 10 feet measured 3.74 watts compared to our targeted performance of 2 watts and power received at 10 to 15 feet measured 1.06 watts compared to our targeted performance of 1 watt.

5.5 Watts compared to around 100 mW (at best)? Only a factor of 55 to 165 off after a further 2 years of work. Talk about diminished expectations. How can the bulls continue to support Energous after such a letdown? I guess it's better to continue to support than admit you were bamboozled by them.

Did they actually get that amount of power transferred? It's possible, you just have to be damn sure the transmitter is in a Faraday cage or you're a looooong way from it when it's switch on. Put those power numbers into the SAR danger-zone distance and you're looking at 10's of meters, and most likely polluting the surrounding spectrum outside the 902 to 928 MHz range in violation of FCC Part 18.305. I hope their staff weren't exposed to that!

Until the next post, take care, and Happy New Year to all.